Blue Chip Stock | Web Scraping Tool | ScrapeStorm

Abstract:Blue chip stocks refer to stocks of listed companies with stable performance, large market capitalization, leading industry position and strong dividend ability. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

Blue chip stocks refer to stocks of listed companies with stable performance, large market capitalization, leading industry position and strong dividend ability. They are usually large and mature companies (such as Apple, Microsoft, and Coca-Cola) and are regarded as the “core assets” in the investment portfolio.

Applicable Scene

Suitable for investors with low risk appetite and seeking stable returns, or as a risk diversification allocation tool. In market fluctuations or recessions, blue-chip stocks are often regarded as a “safe haven” due to their strong risk resistance.

Pros: Strong profitability, stable cash flow, and relatively small stock price fluctuations. Most blue chip stocks pay dividends over the long term, providing investors with stable cash flow.

Cons: The growth rate of mature industries has slowed down, and the stock price elasticity is low, which may underperform high-growth stocks. In an economic recession, blue-chip stocks may see a decline in earnings (such as consumer stocks being hit by shrinking demand).

Legend

1. Blue Chip Stock.

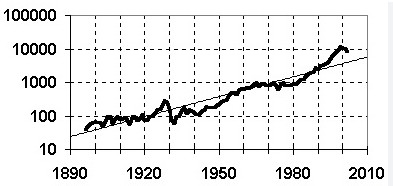

2. Blue Chip Stock.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Blue_chip_(stock_market)

https://www.morningstar.com/stocks/10-best-blue-chip-stocks-buy-long-term