Return on Equity (ROE) | Web Scraping Tool | ScrapeStorm

Abstract:Return on equity (ROE) is a financial indicator that shows how effectively a company uses the capital raised from shareholders to generate profits. ScrapeStormFree Download

ScrapeStorm is a powerful, no-programming, easy-to-use artificial intelligence web scraping tool.

Introduction

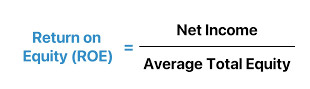

Return on equity (ROE) is a financial indicator that shows how effectively a company uses the capital raised from shareholders to generate profits. Specifically, it is expressed as the ratio of a company’s net income divided by its shareholders’ equity. ROE is an important indicator for shareholders to evaluate the return on investment and is widely used to measure a company’s profitability and capital efficiency.

Applicable Scene

Investors use ROE to assess a company’s profitability and make investment decisions by comparing it to other companies. Companies with high ROE are considered capital efficient and tend to enjoy higher valuations in the stock market. Managers use ROE to analyze capital utilization efficiency.

Pros: ROE is a metric that allows you to see at a glance whether a company is managing its shareholder capital efficiently. Companies with high capital efficiency are considered good investment value. For shareholders, ROE helps them understand the profitability of their investment. Companies with high ROE are considered to have a strong ability to return profits to shareholders.

Cons: ROE does not directly reflect the impact of debt ratio. If a company reduces capital through a large amount of debt, its ROE may be temporarily high, but this may not reflect its actual profitability. Start-ups and fast-growing companies find it difficult to make profits during the investment stage, which often leads to lower ROE. Therefore, it may be difficult to judge future prospects based on ROE alone. ROE standards vary by industry.

Legend

1. ROE formula.

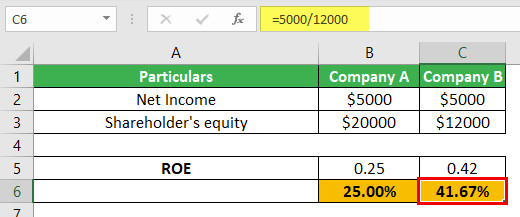

2. ROE example.

Related Article

Reference Link

https://en.wikipedia.org/wiki/Return_on_equity

https://www.investopedia.com/terms/r/returnonequity.asp

https://www.wallstreetprep.com/knowledge/return-on-equity-roe/